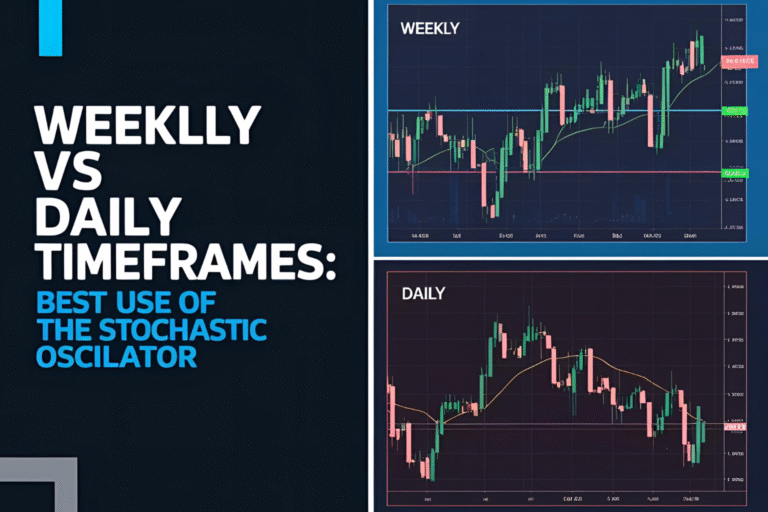

Weekly vs Daily Timeframes: Best Use of the Stochastic Oscillator

Introduction Timeframe selection is a major factor in how effective the stochastic oscillator will be in your trading. Both weekly and daily charts offer different advantages and serve different trading styles. In this post, we’ll explore the comparison between weekly vs daily stochastic oscillator usage and how to decide which is best for your strategy….