Best Stochastic Oscillator Settings for Day Trading

Introduction

Day traders need tools that respond quickly to price changes without overwhelming them with false signals. The stochastic oscillator can do just that—if configured properly. In this post, we’ll break down the best stochastic oscillator settings for day trading, why they matter, and how to adjust them for different intraday timeframes.

Why Settings Matter in Day Trading

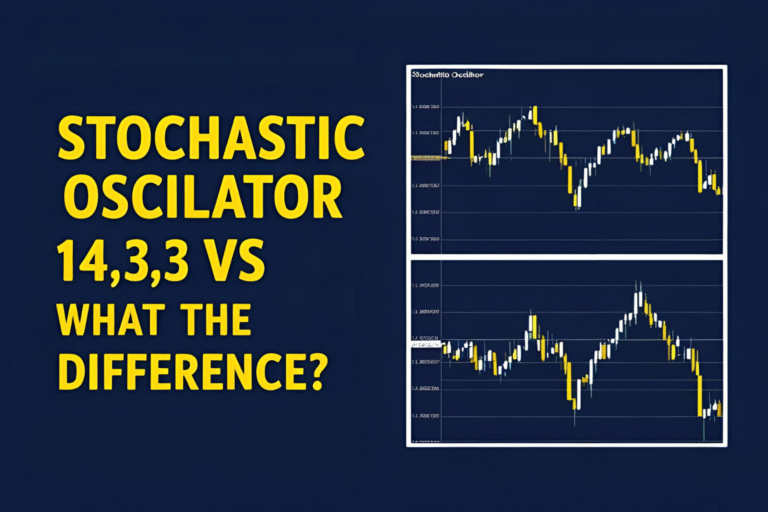

In day trading, decisions must be made quickly. The default stochastic settings (14,3,3) are reliable for longer timeframes, but they’re too slow for fast-moving intraday markets. Adjusting the settings makes the oscillator more responsive to short-term price action.

Recommended Settings for Day Traders

🔹 Setting 1: 5,3,3 – Fast and Responsive

- %K Period: 5

- %K Smoothing: 3

- %D Period: 3

Use case: Best for 5-min and 15-min charts. Offers fast entry/exit signals.

Downside: Higher risk of false signals; always confirm with trend direction or volume.

🔹 Setting 2: 9,3,3 – Balanced for Scalping

- %K Period: 9

- %K Smoothing: 3

- %D Period: 3

Use case: More stable than 5,3,3. Great for traders who want a balance of speed and accuracy.

Tip: Combine with support/resistance levels for stronger signals.

🔹 Setting 3: 8,5,3 – Custom Smoothing

- %K Period: 8

- %K Smoothing: 5

- %D Period: 3

Use case: Adds extra smoothing to %K, reducing whipsaws on volatile stocks.

Best for: 15- to 30-min charts.

How to Use These Settings in Practice

- Identify trend direction using moving averages.

- Wait for %K to cross %D below 20 (buy) or above 80 (sell).

- Look for confluence with chart patterns or volume spikes.

- Avoid taking signals against the trend unless supported by divergence or breakout.

Tips to Optimize Your Intraday Setup

- Always test on a demo account first.

- Use volume filters or price action context for extra confirmation.

- Avoid trading every signal—quality > quantity.

- Consider combining stochastic with VWAP or MACD for trend alignment.

Conclusion

The best stochastic oscillator settings for day trading are typically shorter periods like 5,3,3 or 9,3,3, which provide quicker signals suitable for fast-paced markets. However, don’t rely on one indicator alone—combine it with other tools to boost your accuracy and confidence.

FAQs

Q1. Is 5,3,3 better than 14,3,3 for day trading?

Yes, 5,3,3 is faster and more responsive for short-term price action.

Q2. What is the most reliable setting for 15-minute charts?

9,3,3 offers a good balance between sensitivity and signal clarity.

Q3. Can I use stochastic oscillator alone for day trading?

It’s not recommended. Combine it with other indicators like VWAP or MACD.

Q4. What timeframes work best for stochastic in day trading?

1-minute to 30-minute charts are most commonly used.

Q5. How do I reduce false signals?

Avoid signals against the trend, and confirm with price action or volume.